Top 8 Gold IRA Depositories: Compare IRS-Approved Facilities

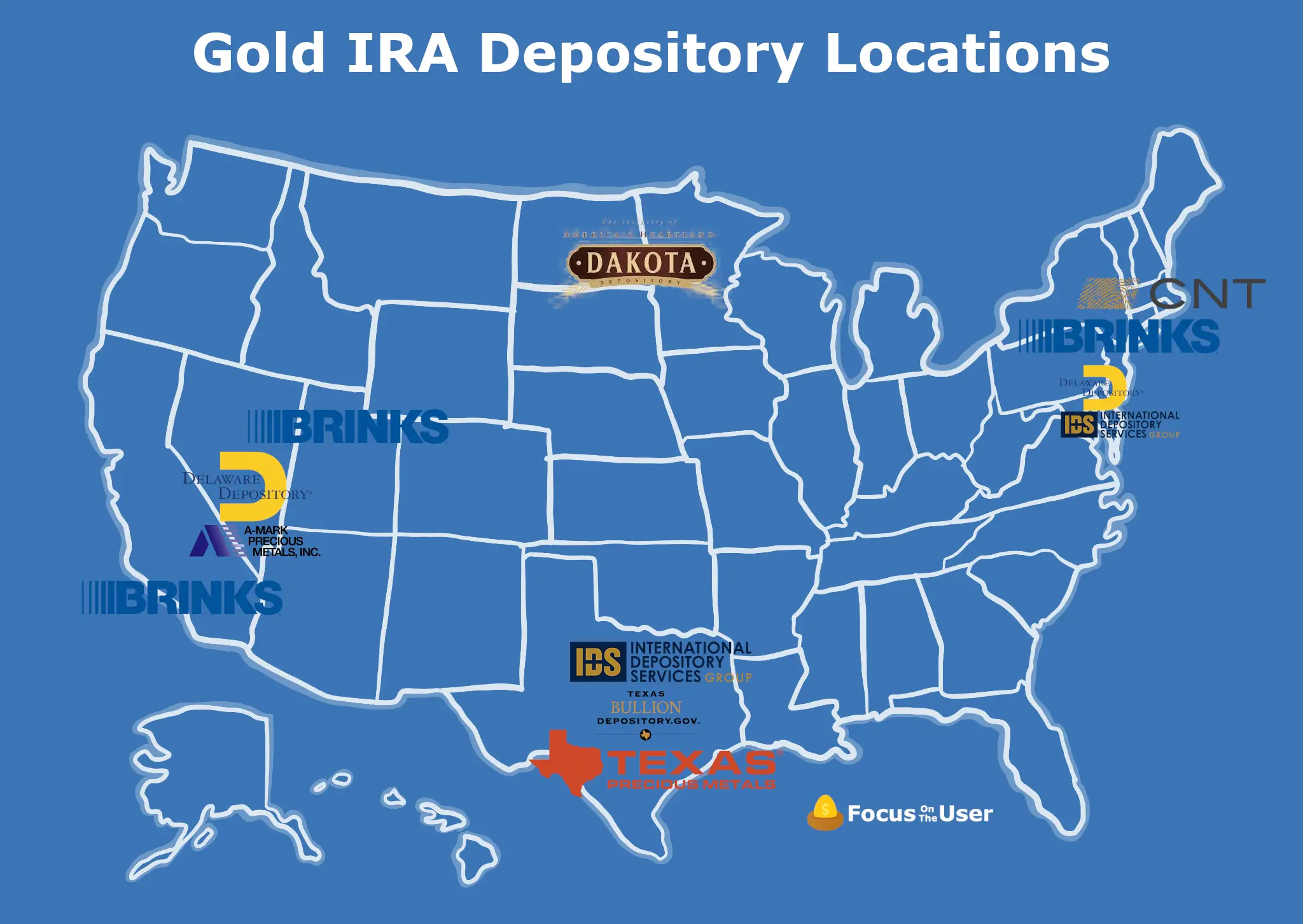

Compare the top 8 Gold IRA depositories approved by the IRS to store physical precious metals in your retirement account. Focus on the User ranks the most popular Gold IRA approved depository options used by leading companies and custodians.

What is a Gold IRA Depository?

A Gold IRA depository (also known as a precious metals depository) is an IRS-approved facility that stores physical gold, silver, platinum, and palladium for Gold IRA account holders. The depository's role is to protect IRA-allowed precious metals with strict security protocols and rigorous storage standards such as Class 3 vaults.

Depositories carry all-risk insurance policies underwritten by Lloyd's of London, covering loss, theft, in-transit damage, fire, and natural disasters. Depository insurance coverage includes total vault coverage up to $1 billion, with individual account coverage ranging from $50-$200 million, depending on the depository and its policy.

Metals purchased in a Gold IRA are shipped to the depository's vaulting facility. The metals are held in a segregated or non-segregated account identified by your name or a unique account number. All Gold IRA depositories must meet strict IRS standards for precious metals storage, including detailed reporting and proper segregation of client assets. These depositories are subject to regular independent audits to verify Gold IRA holdings and compliance.

As of 2025, there are several IRS-approved Gold IRA depositories in the U.S., each offering different storage options while partnering with a variety of custodians. A depository is not the same as a custodian. A depository focuses on the physical storage and protection of your metals in individual retirement accounts, while a custodian is responsible for account administration tasks with your Gold IRA company.

| Depository | IRS-Approved | Locations | Storage Types | Features | Downsides |

|---|---|---|---|---|---|

| Delaware Depository (DDSC) | Yes | Wilmington, DE and Boulder City, NV | Segregated and non-segregated | Widely used, many partnerships | Only East Coast storage location |

| Brink's Global Services USA, Inc. | Yes | Salt Lake City, UT, New York, NY, and Los Angeles, CA, among other locations | Segregated and non-segregated | Global brand, multiple U.S. vaults | Less specialized in Gold IRAs |

| Texas Precious Metals Depository (TPMD) | Yes | Shiner, TX | Segregated | Privately held Texas facility | Limited storage options |

| International Depository Services (IDS) Group | Yes | Dallas, TX and New Castle, DE | Segregated and non-segregated | Multiple U.S. facilities | Less brand recognition |

| CNT Depository, Inc. | Yes | Bridgewater, MA | Segregated | Largest privately owned company in the precious metals industry | Single storage facility, limited storage options |

| A-M Global Logistics (AMGL) | Yes | Las Vegas, NV | Segregated and non-segregated | Storage option for West Coast investors | Less brand recognition |

| Dakota Depository Company | Yes | Fargo, ND | Segregated and non-segregated | Serves Midwest investors | Partnerships are limited |

| Texas Bullion Depository (TBD) | Yes | Leander, TX | Segregated and non-segregated | First state-administered bullion depository in U.S. | Limited partnerships with custodians and companies |

1. Delaware Depository (DDSC)

Delaware Depository (DDSC) is the most popular depository for Gold IRA investors, partnering with most Gold IRA companies and custodians as a trusted IRS-approved storage facility.

Delaware Depository provides Gold IRA storage at two U.S. vaults in Wilmington, DE and Boulder City, NV. Both facilities meet Class 3 security standards and carry $1 billion in all-risk Lloyd’s coverage. Storage is available in segregated or non-segregated formats with Delaware Depository Service Company. The jurisdiction of their storage is Delaware and Nevada. Focus on the User rates Delaware Depository the best Gold IRA depository as an "all-rounder" fit for most Gold IRA investors.

2. Brink's Global Services USA, Inc.

Brink’s Global Services USA is a well-known IRS-approved depository with a long-established name in secure logistics and bullion storage for Gold IRAs. Brink’s is commonly partnered with top custodians due to its multi-state U.S. vault network.

Brink’s Global Services USA offers IRS-approved Gold IRA storage at select U.S. facilities. Specific locations vary including Los Angeles, New York City, and Salt Lake mentioned, with availability depending on your custodian. Storage with Brink's is available in segregated and non-segregated storage, backed by all-risk Lloyd’s of London coverage. This depository is best for investors wanting broad storage options with a strong brand behind it.

3. Texas Precious Metals Depository (TPMD)

Texas Precious Metals Depository (TPMD) is a privately operated depository in Shiner, Texas, offering IRS-approved segregated storage for Gold IRAs.

TPMD provides vaulting under Texas jurisdiction, with all-risk Lloyd’s of London coverage. Pricing is public and competitive at 0.50% annually for gold, platinum, and palladium, and 0.60% for silver, with a $10 monthly minimum. Focus on the User rates this depository best for investors seeking a Texas-based, fully segregated storage option.

4. International Depository Services (IDS) Group

International Depository Services (IDS) Group operates IRS-approved facilities in New Castle, DE and Dallas, TX offering storage for Gold IRAs.

IDS Group offers segregated and non-segregated storage options for precious metal assets. They are also recognized for CME and ICE settlement with all-risk Lloyd’s coverage. This depository is a top choice for those looking for storage on the East Coast and Texas.

5. CNT Depository, Inc.

CNT Depository, Inc. in Bridgewater, Massachusetts, is an IRS-approved facility specializing in segregated precious metals storage for Gold IRAs. CNT does not provide non-segregated storage.

CNT is a CME-approved depository and carries all-risk Lloyd’s coverage with jurisdiction in Massachusetts. If you are interested in storage in New England jurisdiction, CNT Depository is the best depository.

6. A-M Global Logistics (AMGL)

A-M Global Logistics (AMGL) is an IRS-approved depository in Las Vegas, Nevada, offering Gold IRA storage with both segregated and non-segregated options.

AMGL’s storage is backed by all-risk Lloyd’s of London coverage, with jurisdiction in Nevada. Focus on the User highlights this depository for those seeking Nevada-based vault storage for your Gold IRA.

7. Dakota Depository Company

Dakota Depository Company in Fargo, North Dakota, is another IRS-approved depository offering segregated and allocated storage for Gold and Precious Metal IRAs.

Its jurisdiction in the United States is North Dakota, and coverage is provided under all-risk insurance, but we noticed the details are not publicly specified. This Midwest-based facility is another depository option for fully allocated storage.

8. Texas Bullion Depository (TBD)

Texas Bullion Depository is the only state-administered precious metals depository operated under the Texas Comptroller in the United States that's IRS-approved for Gold IRAs. TBD's storage facilities are located in Leander, Texas, offering segregated and non-segregated storage with state-backed oversight.

While Texas Bullion Depository is an IRA-approved storage facility in the state of Texas, it has limited availability for Gold IRAs. Currently, the only custodian partner is Equity Trust Company, limiting investment options compared to widely partnered depositories like Delaware Depository or Brink’s.

How to Choose the Right Depository

To select a Gold IRA depository, first confirm which IRS-approved facilities your chosen Gold IRA company and custodian partner with. Focus on the User lists depository partnerships on both our ranked Gold IRA companies and custodians.

Next, compare factors between the storage facilties including storage fees, storage location, and the types of storage offered. Focus on the User lists these depository features above to help you easily compare your options. You should also compare depository customer service, customer reviews, and industry ratings to understand their service history in storing metals for added peace of mind.

Differences Between Gold IRA Depositories

Not all depositories are the same. These storage facilities can have different storage types, locations, and partnerships which can impact who you end up storing your Gold IRA with.

Primary differences to compare in storage facilities:- Storage Types: Not every IRS-approved depository offers both segregated and non-segregated storage. Some only offer one type which may impact your storage decision.

- Location: All IRS-approved depositories for Gold IRAs are located within the United States, but they operate in different states and jurisdictions.

- Partnerships: Each depository partners with specific Gold IRA companies and custodians, making available storage choices dependent on which partners your custodian works with.

How Depositories Partner with Custodians and Gold IRA Companies

Gold IRA depositories partner with IRA custodians and Gold IRA companies to manage the secure storage, transferring, and recordkeeping of your precious metals. When you purchase metals for your IRA, your custodian arranges shipment and coordinates with the selected depository, which receives and verifies the delivery before storing the metals in your account.

Gold IRA companies often recommend depositories based on their partnerships, but some custodians allow you to choose from a list of approved facilities. Records of all transactions, account balances, and inventory reports are shared between the depository and your custodian to maintain accurate oversight. Depositories provide regular audit reports at least once a year to custodians, who use this information to verify holdings and fulfill Internal Revenue Service reporting requirements.

When you add more metals to your Precious Metals IRA like gold coins or gold bars, your custodian will process the purchase and arrange shipment to your existing depository account, where the metals are recorded and held on your behalf.

Depository FAQ

Visiting the depository storing your Gold IRA is usually not allowed for security reasons. Some storage providers may offer scheduled visitations but this is rare and must be arranged with your custodian.

Most of the time you will be able to choose the depository you use to store your Gold IRA, however this depends on the company or custodian you work with. They may only partner with certain storage providers so it is important to confirm storage options before storing your metals.

Not all depositories are IRS-approved for Gold IRAs. Only facilities that meet IRS requirements and work with Gold IRA custodians are eligible to hold precious metals for retirement investors under strict Gold IRA rules and IRS regulations. IRS-approved depositories must meet compliance standards outlined in Section 408 of the Internal Revenue Code.

Similar to home storage for Gold IRAs, which the IRS does not recognize as an approved option, only IRS-approved depositories qualify. Precious metal depositories such as Loomis International, Malca-Amit Depository, and First State Depository provide asset management but are not IRS-approved for Gold IRAs. The storage facilities we've listed above are 100% IRS-approved for Self-Directed IRAs and partner with top custodians and companies.

Depository fees to expect when storing your Gold IRA include annual storage charges, insurance fees, and account maintenance costs. Storage costs vary by depository and storage types. These charges in a Gold IRA are only part of the fees in opening this type of account which can impact your retirement savings.

You can switch depositories after opening a Gold IRA by transfering metals from one IRS-approved depository to another. The process must be coordinated through your custodian for compliance and there may be transfer or shipping fees.

Gold IRA depositories meet or exceed banking and treasury-level security standards, with Class 3 vault ratings being an industry-standard. A Class 3 vault is designed to resist extended burglary attempts with reinforced construction, time-delay locks, seismic detectors, biometric access, 24/7 surveillance security monitoring, and multiple layers of network security systems. Class 3 vaults ensure maximum secure storage for a Gold IRA with a variety of security features.

These depositories do not use Class M vaults. For Gold IRAs, the standard is UL Class 3 vaults, the highest security rating recognized in the United States for depository storage with advanced security features. If a depository is acquired, reorganized, or fails, custodians are required to transfer holdings to another IRS-approved facility, adhering to standard security measures.

Depository audits are conducted at least once a year, with continuous internal and external audits on inventory checks either daily or weekly.

How Focus on the User Chose These Popular Gold IRA Storage Facilities

Focus on the User listed the most popular Gold IRA approved depositories based on several factors, including their reputation, service offerings, ratings, and their partnerships with trusted Gold IRA companies and custodians. Once you've compared eligible depositories, you can next decide on a Gold IRA company to open a Gold SDIRA.